Introduction

Ethereum has been turning heads once again—and this time, the buzz is bigger than usual. As ETH gains serious momentum against competitors like Solana (SOL) and Ripple (XRP), talk of a possible $10,000 price tag is heating up. Wild? Maybe. Impossible? Definitely not.

Let’s break down what’s pushing Ethereum ahead, how it’s leaving SOL and XRP in the dust, and whether a five-digit ETH is actually on the horizon.

Bonus Section: Ethereum vs. SOL vs. XRP (Quick Comparison Table)

| Feature | Ethereum (ETH) | Solana (SOL) | Ripple (XRP) |

|---|---|---|---|

| Consensus | Proof of Stake (PoS) | Proof of History (PoH) | Federated Consensus |

| Speed | ~15 TPS (L2: 1,000s TPS) | ~65,000 TPS | ~1,500 TPS |

| Decentralization | Highly decentralized | Semi-centralized | Centralized validators |

| Use Cases | DeFi, NFTs, Web3 | DeFi, Gaming | Payments, Remittances |

| Outages | Rare | Frequent | Stable |

| Legal Risks | Moderate | Low | High (SEC lawsuit) |

What’s Driving Ethereum’s Price Momentum?

Institutional Interest and ETF Buzz

Ethereum is getting serious attention from big players. The potential approval of a spot Ethereum ETF in the U.S. is fueling excitement. If Bitcoin ETFs are any clue, ETH could be next to explode. Institutions are looking for exposure, and Ethereum might just be their next big buy.

Ethereum 2.0 and Network Upgrades

With Ethereum’s transition to proof-of-stake now in full effect, the network is faster, more energy-efficient, and way more scalable. Investors love this direction. The Shanghai upgrade and subsequent developments have strengthened confidence in the protocol’s future.

Rising DeFi and NFT Activity on Ethereum

Despite market ups and downs, Ethereum still hosts the largest number of DeFi protocols and NFT marketplaces. It remains the king of smart contracts, making it the default platform for developers and creators.

Ethereum vs. Solana (SOL)

Key Differences Between Ethereum and Solana

While Solana offers high-speed transactions and low fees, Ethereum brings unmatched security, decentralization, and developer activity. It’s like comparing a flashy sports car with a bulletproof SUV.

Why ETH is Outperforming SOL in 2025

ETH has recovered more strongly than SOL in recent months. While Solana battles technical issues, Ethereum’s steady upgrades and community support give it an edge in long-term value.

Solana’s Setbacks: Outages and Centralization Concerns

Solana has faced multiple outages and questions about decentralization. That’s not great when trust is everything. Ethereum, meanwhile, continues to operate with near-flawless uptime and a growing validator base.

Ethereum vs. Ripple (XRP)

XRP’s Legal Troubles with the SEC

Ripple’s long battle with the SEC continues to cast a shadow. While XRP has seen spikes in price, legal uncertainty keeps many investors cautious. Ethereum’s regulatory path is far from perfect, but it’s comparatively cleaner.

Market Confidence in Ethereum Over XRP

Market confidence shows in volume and developer interest. Ethereum still leads by a mile. It’s not just about price—it’s about trust, infrastructure, and ecosystem support.

Liquidity and Developer Activity

Ethereum dominates in terms of liquidity and daily transaction value. More developers are building on ETH than XRP, which adds weight to its bullish case.

Is $10,000 ETH Really Possible?

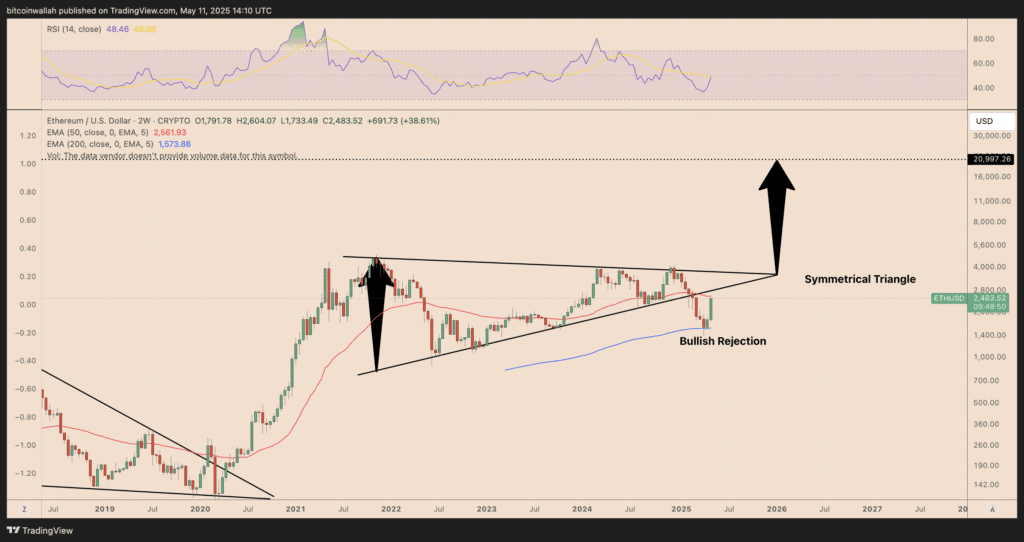

Historical Price Trends and Projections

Let’s look back. ETH went from under $100 in 2019 to over $4,800 in 2021. If history even halfway repeats itself, $10K isn’t a pipe dream—it’s a logical progression.

Expert Opinions and Analyst Forecasts

Plenty of crypto analysts now mention $10K ETH in their 2025–2026 forecasts. While timelines vary, the bullish case rests on fundamentals that are only getting stronger.

Psychological and Technical Resistance Levels

Reaching $10K means breaking several resistance zones, both psychological and technical. But if ETH sustains momentum, especially with ETF news or major adoption waves, it could shatter those ceilings.

Key Catalysts That Could Drive ETH to $10K

Spot ETF Approval in the U.S.

This is the golden ticket. A spot ETH ETF could draw billions in capital, legitimizing Ethereum in the eyes of institutional investors.

Mainstream Adoption of Ethereum-based Apps

Apps like MetaMask, Uniswap, and OpenSea are gateways to Web3—and they all run on Ethereum. More users = more demand = higher ETH prices.

Supply Shock Post-Staking and Burning Mechanisms

With ETH being burned via EIP-1559 and locked in staking contracts, the circulating supply is tightening. Less supply + more demand = price boom.

Risks and Challenges to Watch Out For

Regulatory Uncertainty

Governments are still figuring out how to deal with crypto. Any anti-crypto legislation could slow Ethereum’s ascent, even if it doesn’t stop it.

Competition from Other Blockchains

Cardano, Avalanche, and yes—Solana—are still in the race. One innovation or breakthrough could tip the scales. Ethereum needs to stay ahead.

Scalability Concerns

Even with L2s like Arbitrum and Optimism, Ethereum’s base layer needs to scale better to handle future mass adoption. That’s still a work in progress.

What It Means for Investors

Long-Term vs. Short-Term Strategies

If you’re holding ETH, think long. The fundamentals suggest that patience could pay off big time. Short-term traders should still watch key resistance levels closely.

Diversification and Risk Management Tips

Don’t go all-in. Crypto is still volatile. Combine ETH with BTC and maybe sprinkle in some promising alts to balance your risk.

Ethereum’s Role in the Future of Web3

Smart Contracts and Decentralized Applications

Ethereum is not just a coin—it’s a platform for the next internet. Everything from finance to art is being rebuilt on Ethereum. That’s not something to ignore.

ETH as the Fuel of the Internet of Value

Think of ETH as the “oil” of Web3. Every smart contract execution, NFT mint, or DeFi swap uses ETH. Its utility is what gives it staying power.

Ethereum’s road to $10,000 isn’t guaranteed—but it’s not fantasy either. With institutional interest rising, technical upgrades delivering, and rivals stumbling, ETH is looking stronger than ever. If you’re in crypto for the long haul, keeping an eye on Ethereum might be one of your smartest moves yet.

FAQ

Is Ethereum a good investment in 2025?

Yes, based on current fundamentals, Ethereum continues to show long-term growth potential, especially with the rise of Web3 and DeFi.

What makes Ethereum different from Solana and XRP

Ethereum leads in decentralization, developer activity, and security. Solana is faster but less decentralized, while XRP focuses on cross-border payments but faces legal hurdles.

Can Ethereum realistically reach $10,000?

Yes, it’s possible if market conditions align, institutional money flows in, and Ethereum maintains its dominance in smart contracts and DeFi.

What are the biggest risks to Ethereum’s price growth?

Regulatory crackdowns, competition from other blockchains, and technical issues are the top concerns.

Should I buy ETH now or wait for a dip?

That depends on your risk appetite. If you believe in the long-term vision, dollar-cost averaging might be a good approach.