I am excited to share my insights on the current Bitcoin bull run and what it means for the market.

The recent surge in Bitcoin’s price has grabbed attention. Investors and analysts are watching closely. As I review the BTC price analysis, I’m focusing on key factors. These could influence Bitcoin’s market trends this week.

Here are some key points to consider as we navigate the cryptocurrency market.

The ‘Biggest Signal’ for BTC Bulls Has Arrived

A major signal for BTC bulls has arrived. It’s grabbing attention across the market. Investors and analysts are watching closely. This shift could mark a turning point for Bitcoin.

Breaking Down the Signal’s Technical Significance

The signal is based on Bitcoin’s technical analysis. It points to a possible market upswing. Multiple indicators suggest a bullish trend. To understand it, you need to explore crypto market updates and the factors influencing them.

This signal stands out, as it shows stronger indicators.

As such, it could have a greater impact on the market moving forward he crypto market is very sensitive to things like institutional investments and regulatory news. This signal suggests a strong case for growth. It’s important for investors to understand its implications to make smart choices.

BTC Bulls Get ‘Biggest Signal’ —5 Things to Know in Bitcoin This Week

The crypto space is buzzing with new developments. There are several important things to watch in Bitcoin this week.

1. Bitcoin’s Price Action Following the Fed’s Latest Decision

Bitcoin’s price jumped after the Fed’s decision. This is because investors think the Fed’s stance is good for risky assets.

2. Major Institutional Moves Shaking the Market

Big players have been investing in Bitcoin lately. This move is changing how the market works.

3. Mining Difficulty Adjustment and Its Impact

The BTC mining difficulty adjustment will impact the network’s hash rate. This may affect mining profitability. Watching this closely can offer insights into Bitcoin’s supply.

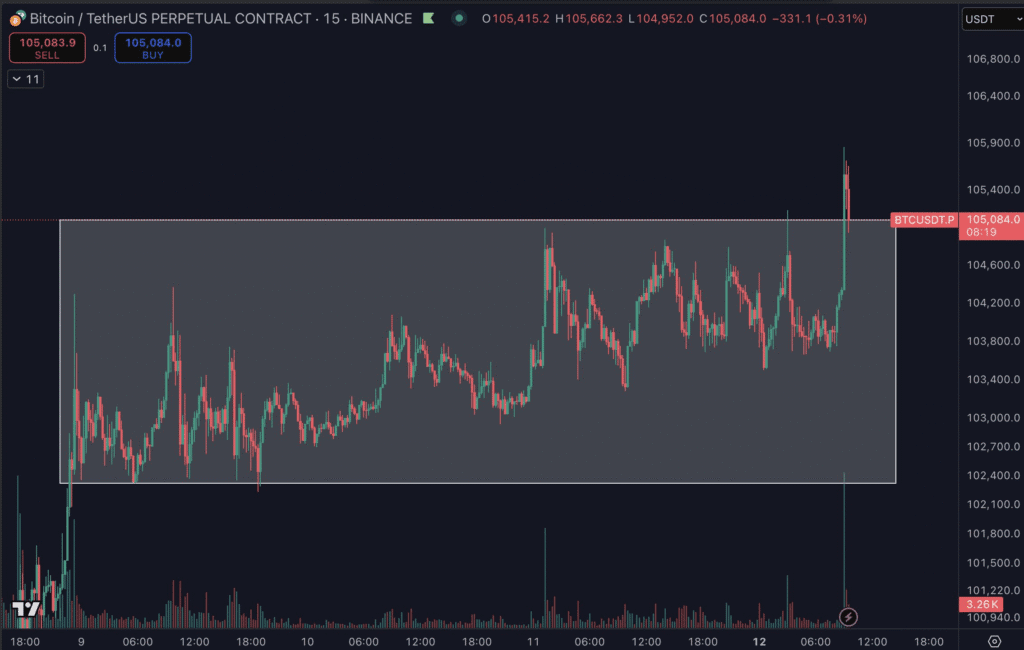

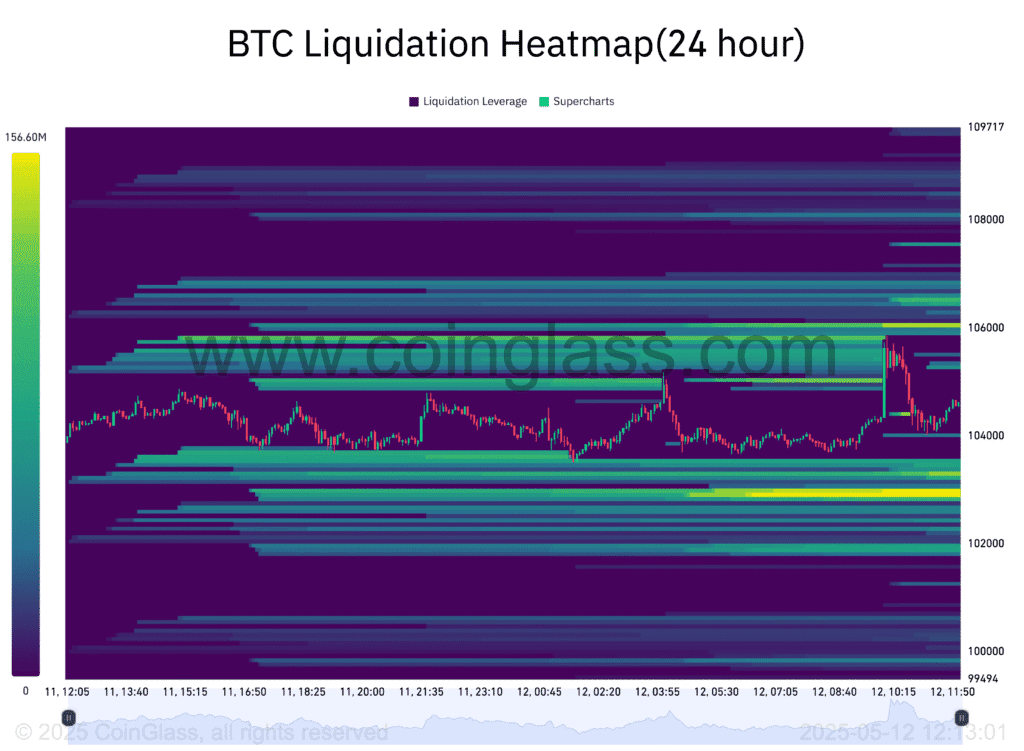

4. Key Support and Resistance Levels to Watch

Bitcoin is getting close to key support and resistance levels. These levels are important for predicting price changes.

5. Upcoming Events That Could Trigger Volatility

Several upcoming events could trigger major Bitcoin price swings. Staying updated is key to navigating the market.

What Leading Bitcoin Analysts Are Predicting Now

Top Bitcoin analysts are sharing their views on the crypto market. Their predictions show a mix of hope and caution.

Bullish Perspectives from Industry Veterans

Industry leaders are seeing positive trends in Bitcoin. They highlight growing adoption and better infrastructure. Many believe the BTC price could rise soon.

Potential Roadblocks to Bitcoin’s Upward Momentum

Challenges lie ahead. Regulatory changes and market fluctuations could impact crypto trends. Investors must stay updated on these changes.

Bitcoin news sites: Link to trusted news outlets like CoinDesk or CoinTelegraph for real-time updates and insights on Bitcoin trends.

Bitcoin technical analysis platforms: Link to platforms like TradingView or CryptoCompare for detailed technical charts and analysis.

Regulatory news: Link to authoritative sources for regulatory updates on Bitcoin, such as government or financial regulatory bodies’ websites (e.g., SEC’s official website).

Navigating Bitcoin’s Market in the Coming Weeks

Understanding the current Bitcoin market is crucial. The ‘biggest signal’ for BTC bulls is here. Investors must adjust their strategies accordingly.

Watching key support and resistance levels is crucial. Also, stay alert to upcoming events that could trigger market swings.

Good BTC trading advice includes tracking institutional moves and mining difficulty changes. This helps traders make better decisions and spot trends early. As the market evolves, staying alert and adjusting strategies is key.

Staying updated with the latest news and insights helps investors make smart choices in the complex world of cryptocurrencies.