What Does “Deflationary” Really Mean for Bitcoin?

Bitcoin being labeled “deflationary” doesn’t mean prices are falling. In crypto terms, it means the supply is decreasing or becoming harder to access due to hoarding or high demand.

Key Factors Behind Bitcoin’s Deflationary Shift:

- Capped supply of 21 million BTC

- Halving events reduce new coin issuance every 4 years

- Massive institutional accumulation (e.g., MicroStrategy)

- Reduced selling pressure as more holders store BTC long-term

MicroStrategy’s Role in This Market Shift

Who Is MicroStrategy?

MicroStrategy is a public business intelligence company led by Bitcoin advocate Michael Saylor. It has become the largest corporate holder of Bitcoin globally.

BTC Holdings Breakdown:

| Date | Total BTC Owned | Estimated Value (USD) |

|---|---|---|

| April 2023 | 129,218 BTC | ~$3.9 Billion |

| January 2024 | 152,800 BTC | ~$5.4 Billion |

| April 2025 | 214,400+ BTC | ~$13.6 Billion |

These purchases outpace the new BTC created daily (approx. 450 BTC post-halving).

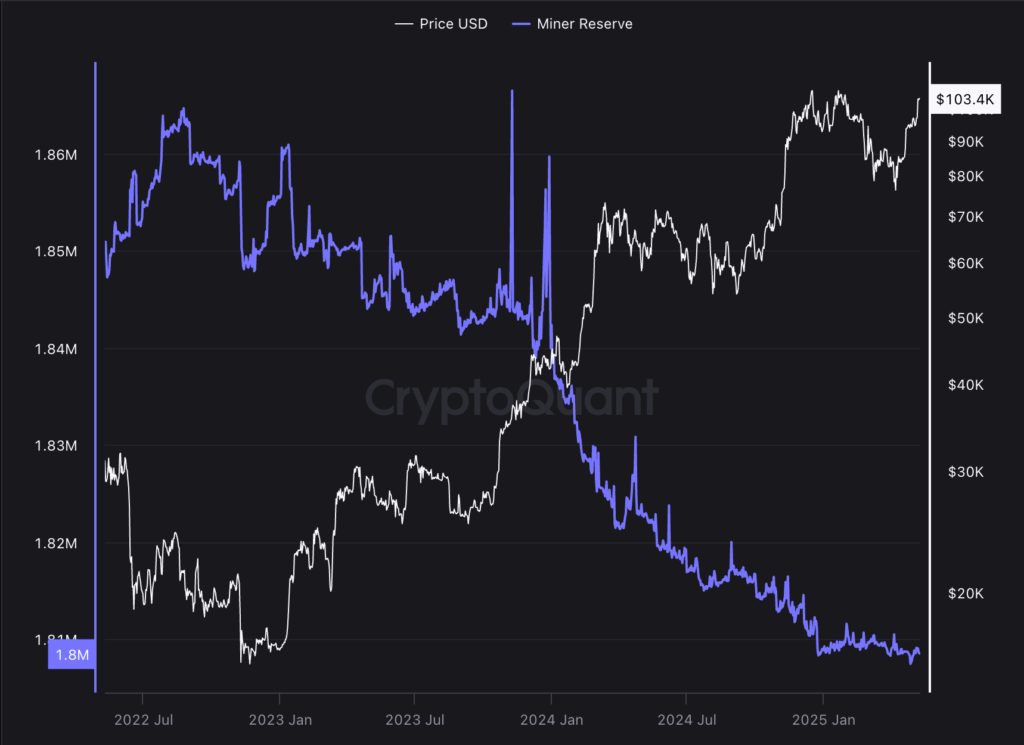

Why This Matters: The Deflationary Equation

Supply vs. Demand

- Daily BTC mined: ~450 coins

- MicroStrategy’s average buy rate: 500+ BTC/day (at peak periods)

What Happens Next?

- Scarcity increases

- Price floor potentially rises

- Volatility may spike due to lower liquid supply

What Should You Do as an Investor?

Consider These Strategies:

- HODL: Holding long-term could be more profitable

- Diversify: Don’t go all-in; balance with other assets

- Track Institutional Moves: Big buyers shape the market now

FAQs

1. What makes Bitcoin deflationary today?

Large-scale purchases outpacing new coin creation.

2. How much BTC does MicroStrategy own?

Over 214,000 BTC — the largest corporate holder.

3. Does this affect Bitcoin’s price?

Yes, reduced supply can push prices higher over time.

4. Is Bitcoin’s supply truly limited?

Yes, it’s capped at 21 million coins by design.

5. What should new investors consider?

Start small, do research, and understand long-term value.